Business

Beer Giants At Play: Anheuser-Busch InBev and SABMiller Agree On Takeover Deal

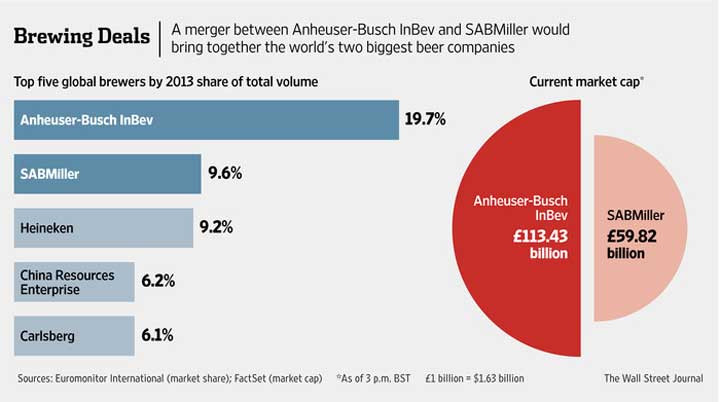

Remember back in September when we reported rumours of Anheuser-Busch InBev approaching SABMiller with a takeover bid? Well, those rumours have resulted in fruition; SABMiller has accepted the fifth takeover offer that Anheuser-Busch InBev has offered, after having rejected previous ones for being too low.

In a statement issued to the press, the companies confirmed that “the Board of SABMiller has indicated to AB InBev that it would be prepared unanimously to recommend the all-cash offer.” The bid is worth a staggering $106 billion, and Anheuser-Busch InBev have agreed to a ‘best efforts’ commitment to clear all regulatory procedures prior to the official sale. If it is not able to clear these procedures, it will have to pay SABMiller $3 billion.

Problems with regulator clearances are expected, as the deal could lead to a decrease in choice for customers and prevent any healthy competition. At present, Anheuser-Busch InBev makes popular products like Budweiser and Corona, while SABMiller manufactures Fosters and Castle. A merge will tap into sales of over $70 billion per year and the opportunity to expand worldwide.

Anheuser-Busch InBev has been given until October 28th to clear regulations and put together a formal offer.